Zero Rated Supplies Made Without Payment Of Tax . the input tax is directly attributable to taxable supplies (i.e. The only difference is that gst of 0% is. The formula prescribed under rule 89 (4) is. zero rated is a supply of any goods and services on which no tax is payable but the credit of input tax related to that supply is. You must be certain that at the point of supply,.

from osome.com

The formula prescribed under rule 89 (4) is. the input tax is directly attributable to taxable supplies (i.e. The only difference is that gst of 0% is. zero rated is a supply of any goods and services on which no tax is payable but the credit of input tax related to that supply is. You must be certain that at the point of supply,.

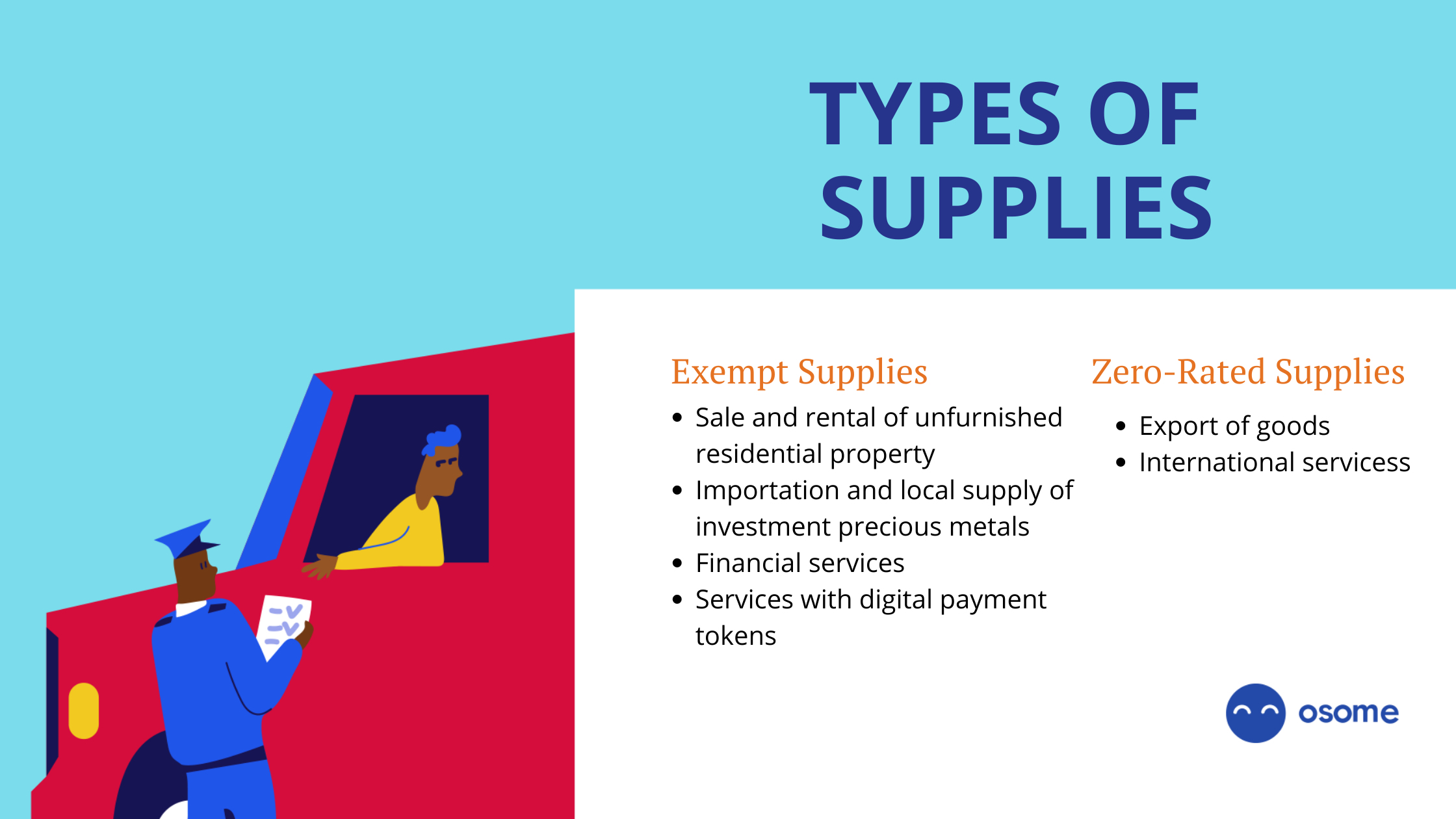

Goods and Services Tax (GST) in Singapore What Is It?

Zero Rated Supplies Made Without Payment Of Tax zero rated is a supply of any goods and services on which no tax is payable but the credit of input tax related to that supply is. You must be certain that at the point of supply,. zero rated is a supply of any goods and services on which no tax is payable but the credit of input tax related to that supply is. The formula prescribed under rule 89 (4) is. the input tax is directly attributable to taxable supplies (i.e. The only difference is that gst of 0% is.

From www.vrogue.co

What Is Zero Rated And Exempted Vat In Uae Detailed G vrogue.co Zero Rated Supplies Made Without Payment Of Tax The only difference is that gst of 0% is. You must be certain that at the point of supply,. The formula prescribed under rule 89 (4) is. zero rated is a supply of any goods and services on which no tax is payable but the credit of input tax related to that supply is. the input tax is. Zero Rated Supplies Made Without Payment Of Tax.

From www.youtube.com

Difference between Zerorated & Exempt VAT Supplies in UAE YouTube Zero Rated Supplies Made Without Payment Of Tax the input tax is directly attributable to taxable supplies (i.e. The only difference is that gst of 0% is. You must be certain that at the point of supply,. zero rated is a supply of any goods and services on which no tax is payable but the credit of input tax related to that supply is. The formula. Zero Rated Supplies Made Without Payment Of Tax.

From shahdoshi.com

Nil Rated Supply Under The GST Regime Shah & Doshi Chartered Accountants Zero Rated Supplies Made Without Payment Of Tax zero rated is a supply of any goods and services on which no tax is payable but the credit of input tax related to that supply is. You must be certain that at the point of supply,. the input tax is directly attributable to taxable supplies (i.e. The only difference is that gst of 0% is. The formula. Zero Rated Supplies Made Without Payment Of Tax.

From www.nicepng.com

Download How Gst Works On A Zero Rated Supply Supply Chain Of Gst Zero Rated Supplies Made Without Payment Of Tax the input tax is directly attributable to taxable supplies (i.e. The formula prescribed under rule 89 (4) is. zero rated is a supply of any goods and services on which no tax is payable but the credit of input tax related to that supply is. The only difference is that gst of 0% is. You must be certain. Zero Rated Supplies Made Without Payment Of Tax.

From quickbooks.intuit.com

What are Zero Rated Supplies Under GST? QuickBooks Zero Rated Supplies Made Without Payment Of Tax the input tax is directly attributable to taxable supplies (i.e. You must be certain that at the point of supply,. The only difference is that gst of 0% is. zero rated is a supply of any goods and services on which no tax is payable but the credit of input tax related to that supply is. The formula. Zero Rated Supplies Made Without Payment Of Tax.

From www.cogoport.com

Export of Goods Without Payment Of IGST Refund Zero Rated Supplies Made Without Payment Of Tax zero rated is a supply of any goods and services on which no tax is payable but the credit of input tax related to that supply is. You must be certain that at the point of supply,. The formula prescribed under rule 89 (4) is. The only difference is that gst of 0% is. the input tax is. Zero Rated Supplies Made Without Payment Of Tax.

From taxconcept.net

ZERORATED SUPPLY V NIL RATED SUPPLY UNDER GST TAXCONCEPT Zero Rated Supplies Made Without Payment Of Tax zero rated is a supply of any goods and services on which no tax is payable but the credit of input tax related to that supply is. You must be certain that at the point of supply,. The only difference is that gst of 0% is. the input tax is directly attributable to taxable supplies (i.e. The formula. Zero Rated Supplies Made Without Payment Of Tax.

From gstguntur.com

Zero Rated Supply What is Zero Rated Supply? Detailed Account and Zero Rated Supplies Made Without Payment Of Tax You must be certain that at the point of supply,. The only difference is that gst of 0% is. zero rated is a supply of any goods and services on which no tax is payable but the credit of input tax related to that supply is. the input tax is directly attributable to taxable supplies (i.e. The formula. Zero Rated Supplies Made Without Payment Of Tax.

From blog.saginfotech.com

Full Details of Zerorated Supplies in GST with SEZ Benefits Zero Rated Supplies Made Without Payment Of Tax zero rated is a supply of any goods and services on which no tax is payable but the credit of input tax related to that supply is. The only difference is that gst of 0% is. You must be certain that at the point of supply,. The formula prescribed under rule 89 (4) is. the input tax is. Zero Rated Supplies Made Without Payment Of Tax.

From www.taxscan.in

Documents to Defect of Zero Rated Supplies without Tax Payment Zero Rated Supplies Made Without Payment Of Tax The formula prescribed under rule 89 (4) is. zero rated is a supply of any goods and services on which no tax is payable but the credit of input tax related to that supply is. The only difference is that gst of 0% is. the input tax is directly attributable to taxable supplies (i.e. You must be certain. Zero Rated Supplies Made Without Payment Of Tax.

From slideplayer.com

Standardised PPT on GST ppt download Zero Rated Supplies Made Without Payment Of Tax The formula prescribed under rule 89 (4) is. You must be certain that at the point of supply,. The only difference is that gst of 0% is. the input tax is directly attributable to taxable supplies (i.e. zero rated is a supply of any goods and services on which no tax is payable but the credit of input. Zero Rated Supplies Made Without Payment Of Tax.

From www.studocu.com

ZERO Rated Supplies ZERO RATED SUPPLIES 0 Certain basic food Zero Rated Supplies Made Without Payment Of Tax the input tax is directly attributable to taxable supplies (i.e. You must be certain that at the point of supply,. The only difference is that gst of 0% is. The formula prescribed under rule 89 (4) is. zero rated is a supply of any goods and services on which no tax is payable but the credit of input. Zero Rated Supplies Made Without Payment Of Tax.

From saral.pro

A guide to Zero Rated Supplies in GST Zero Rated Supplies Made Without Payment Of Tax The only difference is that gst of 0% is. The formula prescribed under rule 89 (4) is. the input tax is directly attributable to taxable supplies (i.e. You must be certain that at the point of supply,. zero rated is a supply of any goods and services on which no tax is payable but the credit of input. Zero Rated Supplies Made Without Payment Of Tax.

From www.slideserve.com

PPT Zerorated and exempt supplies PowerPoint Presentation, free Zero Rated Supplies Made Without Payment Of Tax zero rated is a supply of any goods and services on which no tax is payable but the credit of input tax related to that supply is. The formula prescribed under rule 89 (4) is. You must be certain that at the point of supply,. the input tax is directly attributable to taxable supplies (i.e. The only difference. Zero Rated Supplies Made Without Payment Of Tax.

From legaldbol.com

Zero Rated Tax Invoice Template Cards Design Templates Zero Rated Supplies Made Without Payment Of Tax The only difference is that gst of 0% is. zero rated is a supply of any goods and services on which no tax is payable but the credit of input tax related to that supply is. the input tax is directly attributable to taxable supplies (i.e. The formula prescribed under rule 89 (4) is. You must be certain. Zero Rated Supplies Made Without Payment Of Tax.

From saral.pro

A guide to Zero Rated Supplies in GST Zero Rated Supplies Made Without Payment Of Tax zero rated is a supply of any goods and services on which no tax is payable but the credit of input tax related to that supply is. The formula prescribed under rule 89 (4) is. You must be certain that at the point of supply,. The only difference is that gst of 0% is. the input tax is. Zero Rated Supplies Made Without Payment Of Tax.

From github.com

Incorrect GST Calculation for Sales Invoice SEZ, Without Payment of Zero Rated Supplies Made Without Payment Of Tax You must be certain that at the point of supply,. The only difference is that gst of 0% is. The formula prescribed under rule 89 (4) is. zero rated is a supply of any goods and services on which no tax is payable but the credit of input tax related to that supply is. the input tax is. Zero Rated Supplies Made Without Payment Of Tax.

From www.audiix.com

Zerorated and exempt supplies Zero Rated Supplies Made Without Payment Of Tax The formula prescribed under rule 89 (4) is. The only difference is that gst of 0% is. You must be certain that at the point of supply,. the input tax is directly attributable to taxable supplies (i.e. zero rated is a supply of any goods and services on which no tax is payable but the credit of input. Zero Rated Supplies Made Without Payment Of Tax.